INFLUENCE OF THE

EVENT RATE ON DISCRIMINATION ABILITIES OF BANKRUPTCY PREDICTION MODELS

Lili Zhang1

, Jennifer Priestley2 , and Xuelei Ni3

1Program

in Analytics and Data Science, Kennesaw State University, Georgia, USA

2Analytics

and Data Science Institute, Kennesaw State University, Georgia, USA

3Department

of Statistics, Kennesaw State University, Georgia, USA

ABSTRACT

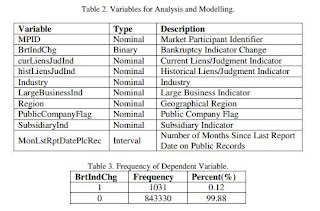

In bankruptcy prediction, the

proportion of events is very low, which is often oversampled to eliminate this

bias. In this paper, we study the influence of the event rate on discrimination

abilities of bankruptcy prediction models. First the statistical association

and significance of public records and firmographics indicators with the

bankruptcy were explored. Then the event rate was oversampled from 0.12% to

10%, 20%, 30%, 40%, and 50%, respectively. Seven models were developed,

including Logistic Regression, Decision Tree, Random Forest, Gradient Boosting,

Support Vector Machine, Bayesian Network, and Neural Network. Under different

event rates, models were comprehensively evaluated and compared based on

Kolmogorov-Smirnov Statistic, accuracy,F1 score, Type I error, Type II error,

and ROC curve on the hold-out dataset with their best probability cut-offs.

Results show that Bayesian Network is the most insensitive to the event rate,

while Support Vector Machine is the most sensitive.

KEYWORDS

Bankruptcy Prediction, Public

Records, Firmographics, Event Rate, Discrimination Ability

.png)

Comments

Post a Comment